MyJar

MyJar entered into administration and is no longer accepting loan applications, but Little Loans could still help you search for a loan.

Little Loans as a MyJar alternative

- Little Loans is a credit broker, not a lender. We work with a large, trusted panel of lenders authorised and regulated by the Financial Conduct Authority (FCA).

- Little Loans can search for loans between £100 up to £10,000.

- Depending on how much you apply to borrow, you could repay your loan in instalments from 3 to 60 months.

- We don’t charge any fees for our credit broking service.

- Check your eligibility for free today with no impact to your credit score.*

*If you decide to go ahead and make a full application for a loan with one of our lenders, you will be required to undergo a hard credit search, which will remain on your credit file for up to 12 months. Too many hard searches in a short period of time could result in a decline to your credit score.

Who was MyJar?

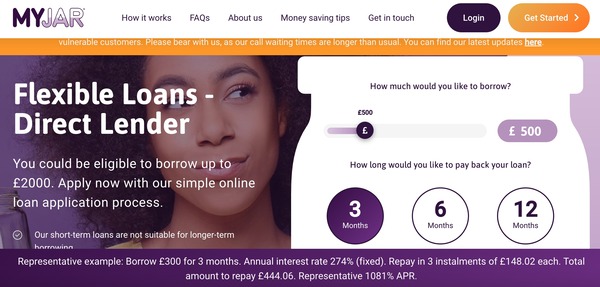

MyJar was a London-based direct lender authorised and regulated by the FCA. The company offered short-term loans between £100 and £2,000, with repayment terms of either 3, 6, or 12 months, depending on the amount of money borrowed.

MyJar did not charge their customers late fees and borrowers could settle the balance of their loan early without incurring additional charges.

Has MyJar gone bust?

Yes. Sadly, MyJar went into administration on December 22, 2020.

Harrison’s Business Recovery & Insolvency were appointed as administrators. Their website states the following: ‘The Directors of MYJAR have made the decision to place the business into administration due to external factors that have placed financial pressure on the business and its ability to trade through these challenges. Mindful of ensuring the business satisfies certain threshold conditions and the difficulties associated with raising additional funding in this economic environment, the directors of MYJAR have placed the Company into Administration.’

Is MyJar still lending?

No, MyJar is not accepting new applications since it ceased trading in December 2020.

Do I have to pay back MyJar?

Borrowers are expected to adhere to their terms and conditions and continue with their MyJar repayments as normal.

Who took over MyJar?

Unfortunately, MyJar was not taken over and is no longer trading.

MyJar loan alternatives

If you’re looking for a loan from a lender like MyJar, Little Loans might be able to help you search.

We’re a credit broker and we work with a panel of over 30 responsible lenders who offer short-term, personal loans from £100 to £10,000. Depending on how much money you apply to borrow, you could repay your loan between 3 and 60 months.

We don’t work with any payday loan providers. Spreading the cost of your loan across a longer term could make the monthly repayments more affordable; however, the longer your loan duration, the more you will pay in interest, so you should think very carefully before deciding if this is the right option for your circumstances.

Who can search for a loan with Little Loans?

You can use Little Loans to search for a MyJar loans alternative if you:

- Are over the age of 18;

- Are a UK resident;

- Have a UK bank account with a valid debit card; and

- Have a regular source of income paid directly into your bank account.

The Little Loans process

If you’re looking for a loan, MyJar is no longer lending, but Little Loans might be able to help you find a suitable alternative provider.

We’d like to take this opportunity to tell you a little bit about our process.

- Select the amount of money you need to borrow and choose your ideal repayment term. Complete our five-minute online form.

- Using soft search technology, we’ll scan our panel of lenders for an ideal match. This should take around 60 seconds.

- If we’ve found you a loan, your result will be displayed on your screen. You can find out more about the loan by clicking through to the lender’s website.

- Should you wish to go ahead with a full application, you will be asked to provide the lender with some further information which will enable them to carry out a hard credit search.

- Once the lender’s checks are complete, if you’ve been approved for a loan, you will be sent a loan agreement. Read through the terms and conditions carefully before deciding whether to sign and return.

How quickly will I receive the money?

If you’re approved for a loan with one of the lenders on the Little Loans panel, it’s possible that your money could be sent the same day your application is approved. It’s important to remember that the time it takes for the money to appear in your account will depend on your bank’s policies and procedures, such as if they accept Faster Payments.

I’m worried about money; where can I go for help?

Free, impartial money and debt management advice can be accessed through various organisations and charities, including StepChange, MoneyHelper, Citizens Advice, and National Debtline.

Representative example: Amount of credit: £1000 for 12 months at £123.40 per month. Total amount repayable of £1,480.77 Interest: £480.77. Interest rate: 79.5% pa (fixed). 79.5% APR Representative. We’re a fully regulated and authorised credit broker and not a lender