Cash ASAP

Are you thinking about searching for a loan?

CashASAP is a UK-based direct lender. We’ve put together this guide to tell you all about them and the products they offer.

If you’re unsure whether CashASAP is the right lender for you, Little Loans could help you search for a suitable alternative.

Eight reasons to choose Little Loans as your CashASAP alternative

- Little Loans is a credit broker with access to over 30 direct lenders.

- All the lenders we work with are based in the UK and authorised and regulated by the Financial Conduct Authority (FCA).

- With Little Loans, you can search for a short-term loan between £100 and £10,000. Depending on the amount of money you apply to borrow, you could repay your loan across a term from 3 to 60 months.

- Our credit broking service is completely free to use.

- Any credit score considered.

- Searching for a loan with Little Loans will not harm your credit score or leave a visible footprint on your credit file.*

- Complete our five-minute online form and find out in just 60 seconds whether you’ve been matched with a loan. Get your free, no-obligation quote today.

- If approved, a number of the lenders on our panel could send your money the same day.**

Who is CashASAP?

CashASAP is a direct lender of payday and short-term loans.

Their website states the following:

‘We are dedicated to ensuring that we act responsibly when lending to our customers. We believe in treating our customers fairly and with respect. It is our policy to promote the following good practices throughout our business:

- transparency

- fair practice and fair treatment of customers

- provision of honest and accurate information.

What loan types does CashASAP offer?

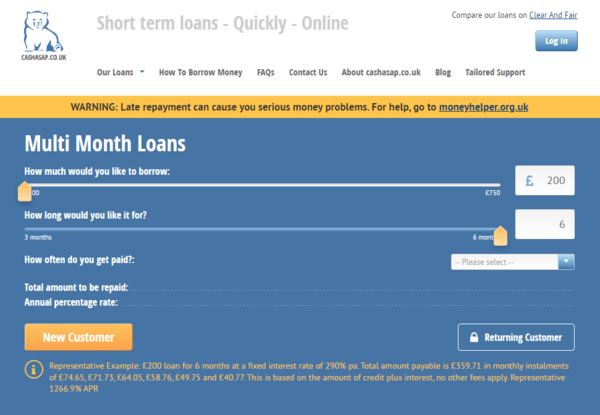

CashASAP provides two different types of loan: payday and multi month. Both are available in different amounts, with various repayment terms, which we’ll talk about in more detail below.

How much money can I apply to borrow with CashASAP?

How much money you can apply to borrow will depend on the type of loan you apply for.

| Loan Type | Loan Amount Available |

|---|---|

| CashASAP payday loan | Between £200 and £300 |

| CashASAP multi month loan | Between £200 and £750 |

What are the repayment terms?

CashASAP payday loans must be repaid within 35 days, while the multi month option allows borrowers to spread the cost of their loan across terms from 3 to 6 months.

What Representative Example does CashASAP advertise?

CashASAP have included the following Representative Example on their website:

£300 loan for 6 months at a fixed interest rate of 290% pa. Total amount payable is £540.35 in monthly instalments of £109.59, £107.60, £100.85, £86.95, £72.25 and £63.11. This is based on the amount of credit plus interest, no other fees apply. Representative 1265.8% APR.

Is CashASAP regulated?

Yes. CashASAP is a trading name of APFIN Ltd, who are authorised and regulated by the Financial Conduct Authority (FCA). You can find their information on the FCA register here.

What do CashASAP customers say?

As of October 2025, CashASAP is rated excellent on Trustpilot, with over 3,400 reviews.

Who can apply for a loan with CashASAP?

CashASAP states that you can apply for one of their loans if you:

- Are over the age of 18;

- Are a UK resident with a UK bank account and linked VISA debit card; and

- Are in full-time or part-time employment.

Will CashASAP allow me to take out more than one loan at the same time?

No, this is not something CashASAP offers. Borrowers are also unable to top up an existing CashASAP loan.

What happens if I miss a repayment?

CashASAP may charge a £10 late fee.

Falling behind on or failing to make your repayments can lead to serious money worries, as well as a decline to your credit score.

If you’ve taken out a loan that you’re struggling to repay, you should contact your lender as soon as possible. While this can feel daunting, please remember that it’s the first step towards taking back control and feeling confident about your money again.

CashASAP states the following on their website:

‘As a responsible lender, we want to help you repay your cashasap.co.uk loan in a way that you can afford and we understand that not everything always goes according to plan ... We may be able to move your scheduled repayment date or to freeze your balance depending on your specific circumstances and the extent to which you need to amend the repayment schedule of your loan. The sooner you contact us the more options we will be able to consider for your account and the lower the total cost of repaying your loan is likely to be.’

Additionally, you can access free, confidential advice on sites such as StepChange, MoneyHelper, Citizens Advice, and National Debtline.

Will I be given a customer account?

Yes, customers will be required to create an online account via the CashASAP website. You can find the log-in page here.

How can I contact CashASAP?

There are a number of ways to get in touch with CashASAP.

You can either:

- Fill out the contact form on their website

- Email info@cashasap.co.uk

- Write to them at APFIN Ltd, 3rd Floor, 12 Gough Square, London, EC4A 3DW.

Alternatively, you can call 0800 488 0905 from Monday to Friday, between the hours of 8am and 5pm, and on Saturdays between 10am to 4pm.

Is it better to search for a loan with a credit broker or apply with a direct lender?

It’s entirely your choice whether you’d like to search through a credit broker or apply directly to a lender.

Finding the right direct lender for you can be time-consuming and confusing, which is where a credit broker could help.

Little Loans can search a panel of over 30 direct lenders at the same time for you.

When you apply directly with a lender, a creditworthiness assessment will be carried out, which could include a hard search. If you make multiple applications with different lenders, you risk multiple hard searches being added to your credit file. This will have a negative impact on your credit score.

Little Loans uses soft search technology, which will not impact your credit score in any way.*

The Little Loans eligibility criteria

Please feel free to use Little Loans credit brokering services to help you search for a loan if you:

- Are over the age of 18;

- Are a UK resident;

- Have a UK bank account and valid debit card; and

- Have a regular source of income paid into your bank account.

*If you’re matched with a loan through a search with Little Loans and you choose to make a full application directly with the lender, a creditworthiness assessment will be carried out by that company. A creditworthiness assessment will involve a hard search or Open Banking. Please be aware that a hard search will be visible on your credit file for up to 12 months, and multiple hard searches in a short period of time will damage your credit score.

**The time it takes for the money to become available in your account will depend on your bank’s policies and procedures.

Representative example: Amount of credit: £1000 for 12 months at £123.40 per month. Total amount repayable of £1,480.77 Interest: £480.77. Interest rate: 79.5% pa (fixed). 79.5% APR Representative. We’re a fully regulated and authorised credit broker and not a lender