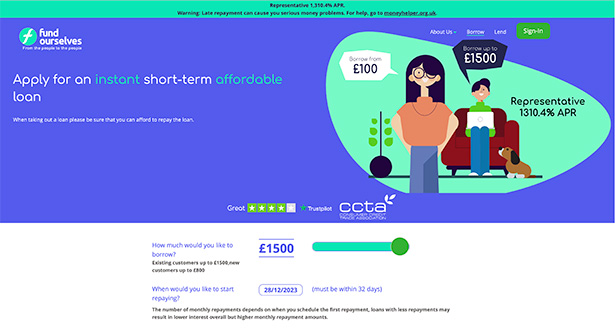

Fund Ourselves Loans – Overview And Alternatives

Looking for a loan between £100 and £10,000? Fund Ourselves is no longer trading, but Little Loans could help you find a suitable alternative.

In our guide, we answer some key questions about what’s happened to Fund Ourselves, as well as share a little bit about the service we provide for customers searching for a Fund Ourselves loan alternative.

Six reasons to choose Little Loans as a Fund Ourselves loans alternative

- Little Loans is a credit broker working with a large panel of over 30 direct lenders.

- We only work with lenders who are authorised and regulated by the Financial Conduct Authority (FCA).

- Fund Ourselves has been placed into administration and is unable to consider new applications for credit. The lenders on the Little Loans panel are actively considering new applications.

- You can search for a loan with Little Loans even if you have bad credit; we work with a number of direct lenders who offer loans for people with bad credit.

- The Little Loans credit broking service is free to use.

- Fill out our online form in under five minutes to receive your personalised, no-obligation loan quote in just 60 seconds.

Has Fund Ourselves gone into administration?

Yes. On July 21, 2025, Fund Ourselves, a peer-to-peer lender of short-term loans, was placed into administration, and this was confirmed by the FCA on July 25, 2025.

Louise Brittain and Robert Young of Azets Holding Limited have been appointed as Joint Administrators.

Why has Fund Ourselves gone into administration?

The FCA state the following on their website:

“A creditor of the firm concluded that the firm was insolvent and applied to Court for an administration order. The Joint Administrators are now responsible for the firm’s affairs and must act in the interest of the firm’s creditors.”

What should I do with my Fund Ourselves loan?

If you’re currently repaying a Fund Ourselves loan, you should continue to make your repayments in line with your credit agreement.

Unless otherwise told by the FCA or administrators, your repayment terms and conditions will remain the same, and a late or missed repayment will damage your credit score.

If you’re worried about anything money or debt related, please consider reaching out to any of the following organisations for free, confidential advice:

I’m a Fund Ourselves investor; what should I do?

At the time of writing on July 29, 2025, the FCA advise that investors should be contacted by the Joint Administrators with further information shortly.

Where can I complain or make a claim about Fund Ourselves?

If you’re a past or present customer of Fund Ourselves and you think you could have been mis-sold a loan, you should discuss your claim with the Joint Administrator support team, details of which can be found in the section below.

How can I contact Fund Ourselves customer service?

Fund Ourselves is in administration, and the company is now being handled by the Joint Administrators, Azets.

If you have any questions about your Fund Ourselves loan, you can get in touch with Azets support team using the contact details below.

Email: fundourselves@azets.co.uk

Mobile: 07858 969 574

Landline: 0207 403 1877

Please note that these details have been shared by the FCA. The mobile number is the designated customer support line, and the landline is the secondary office phone number.

Fund Ourselves in administration: beware of scams

Criminals could use the collapse of a company to their advantage by trying to contact and trick customers into sharing personal and financial information.

If you receive any unexpected communication from somebody claiming to be from Fund Ourselves, please check that the contact details match those provided by the FCA. If you’re in any doubt, please end the phone call or do not reply to the email, and ring one of the numbers above to check the authenticity of the communication.

Little Loans has put together a handy guide to protecting yourself against scams.

Where can I find Fund Ourselves loan reviews?

You can find Fund Ourselves customer reviews on Trustpilot, where, as of July 2025, the company is rated ‘average.’

Can I still apply for a loan with Fund Ourselves?

No, Fund Ourselves has ceased trading, and you cannot apply for new credit from a company that’s entered administration.

What is the alternative to Fund Ourselves?

Looking for a loan between £100 and £10,000?

Little Loans could help you search. The lenders on our panel offer short-term, personal loans with repayment terms from 3 to 60 months, depending on the amount of money you apply to borrow.

Search for a Fund Ourselves loan alternative with Little Loans

You can search for a loan with Little Loans if you:

- Are over the age of 18;

- Are a UK resident;

- Have a UK bank account with a valid debit card; and

- Have a regular source of income paid into your bank account.

Loans for bad credit

Little Loans is proud to work with several direct lenders who specialise in loans for bad credit.

Before you apply for a bad credit loan, please be aware that you could be offered a higher rate of interest, and in some cases, you might not be approved to borrow the full amount of money that you need.

Summary: Fund Ourselves loans administration and alternatives

- As of July 21, 2025, Fund Ourselves has been placed into administration.

- If you have an active Fund Ourselves loan, you should continue making your repayments as normal.

- Fund Ourselves investors will be contacted by the administrators, who will provide further information on the next steps.

- Any questions from either Fund Ourselves customers or investors should be directed to the administrators, Azets Holding Limited.

- It’s no longer possible to make new applications for credit with Fund Ourselves.

- Little Loans is an FCA authorised and regulated credit broker and could help you search for a Fund Ourselves loan alternative.

- The direct lenders on the Little Loans panel offer loans from £100 to £10,000, with repayment terms between 3 and 60 months, depending on the amount of money you apply to borrow.

- You could search for a loan with Little Loans, even if you have bad credit.

Representative example: Amount of credit: £1000 for 12 months at £123.40 per month. Total amount repayable of £1,480.77 Interest: £480.77. Interest rate: 79.5% pa (fixed). 79.5% APR Representative. We’re a fully regulated and authorised credit broker and not a lender